Volume 18, Issue 3 (Autumn 2023)

Salmand: Iranian Journal of Ageing 2023, 18(3): 326-347 |

Back to browse issues page

Download citation:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

Bakhshandeh R, Shariati B, Nasr Esfahani M, Malakouti S K, Kamalzadeh L, Rashedi V. Design and Development of a Financial Capacity Scale for Older Adults in Iran: A Pilot Study. Salmand: Iranian Journal of Ageing 2023; 18 (3) :326-347

URL: http://salmandj.uswr.ac.ir/article-1-2545-en.html

URL: http://salmandj.uswr.ac.ir/article-1-2545-en.html

Razieh Bakhshandeh1

, Behnam Shariati1

, Behnam Shariati1

, Mehdi Nasr Esfahani1

, Mehdi Nasr Esfahani1

, Seyed Kazem Malakouti1

, Seyed Kazem Malakouti1

, Leila Kamalzadeh1

, Leila Kamalzadeh1

, Vahid Rashedi *2

, Vahid Rashedi *2

, Behnam Shariati1

, Behnam Shariati1

, Mehdi Nasr Esfahani1

, Mehdi Nasr Esfahani1

, Seyed Kazem Malakouti1

, Seyed Kazem Malakouti1

, Leila Kamalzadeh1

, Leila Kamalzadeh1

, Vahid Rashedi *2

, Vahid Rashedi *2

1- Department of Psychiatry, Mental Health Research Center, School of Medicine, Iran University of Medical Sciences, Tehran, Iran.

2- Department of Aging, Iranian Research Center on Aging, School of Educational Sciences and Social Welfare, University of Social Welfare and Rehabilitation Sciences, Tehran, Iran. ,vahidrashedi@yahoo.com

2- Department of Aging, Iranian Research Center on Aging, School of Educational Sciences and Social Welfare, University of Social Welfare and Rehabilitation Sciences, Tehran, Iran. ,

Full-Text [PDF 10550 kb]

(1757 Downloads)

| Abstract (HTML) (3279 Views)

Full-Text: (1783 Views)

Introduction

The capacity to manage financial affairs is a multidimensional construct and includes a wide range of judgment, perceptual, and pragmatic activities, ranging from the most basic abilities to higher levels of abilities. With aging, some cognitive functions such as memory, attention, judgment, and managing financial affairs are affected. The decline of cognitive abilities and financial capacity in the elderly can cause problems for them, their families, and society. Due to the fact that so far, no any questionnaire in accordance with the social and cultural conditions of Iranian society has been designed to measure the financial capacity of the elderly, the present study aims to design and develop a tool for measuring the financial capacity of Iranian elderly.

Methods

This study was conducted in four steps using Waltz’s strategy:

● Defining objectives: Identifying the available tools for measuring financial capacity (by information retrieval, combining evidence, interpreting clinical research, evaluating different areas of the tool) and designing the tool through a collaborative process and consensus;

● Selecting a conceptual model: The tools for measuring the financial capacity were found based on a literature search, their contents were analyzed, and the related concepts were extracted;

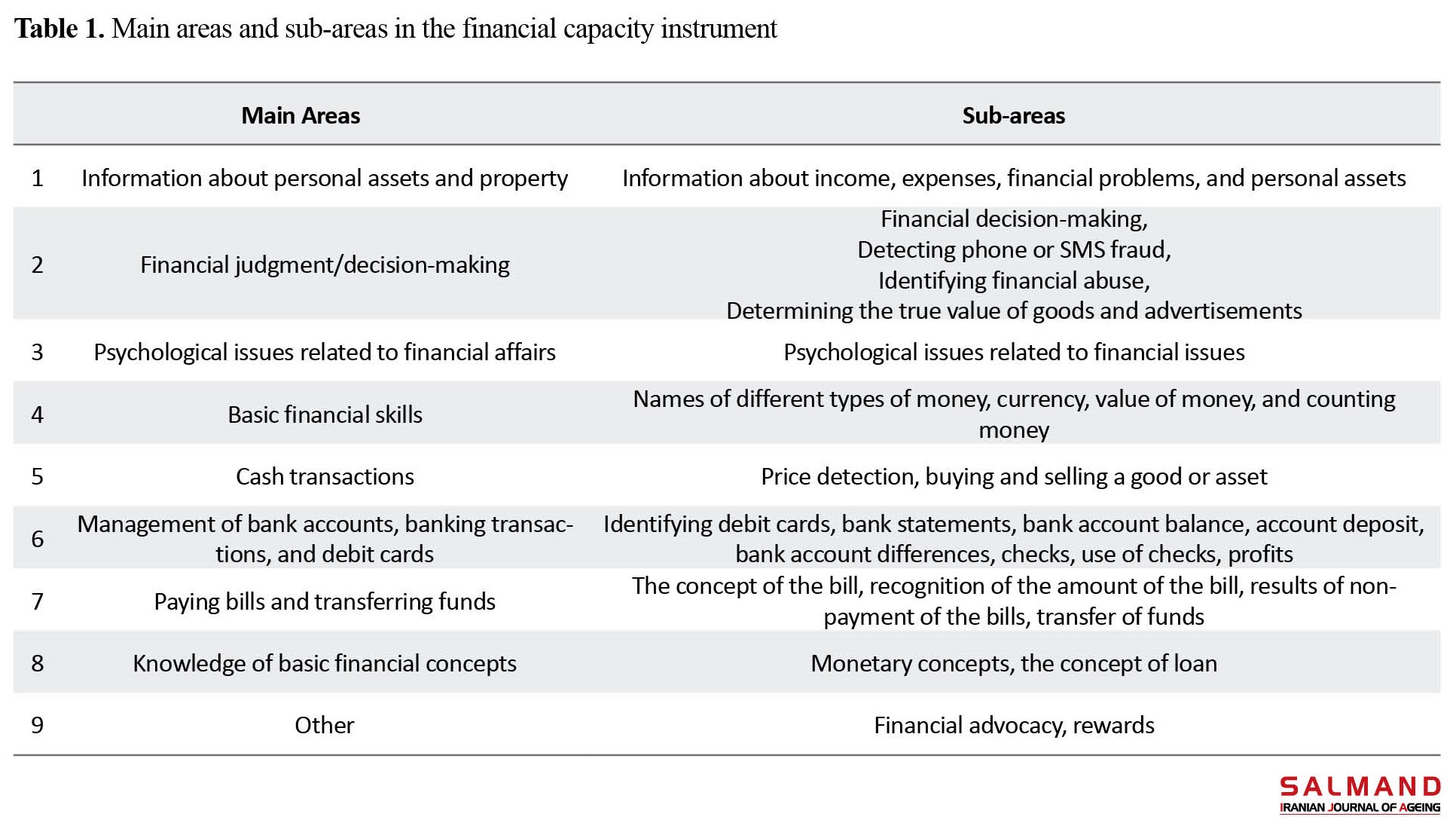

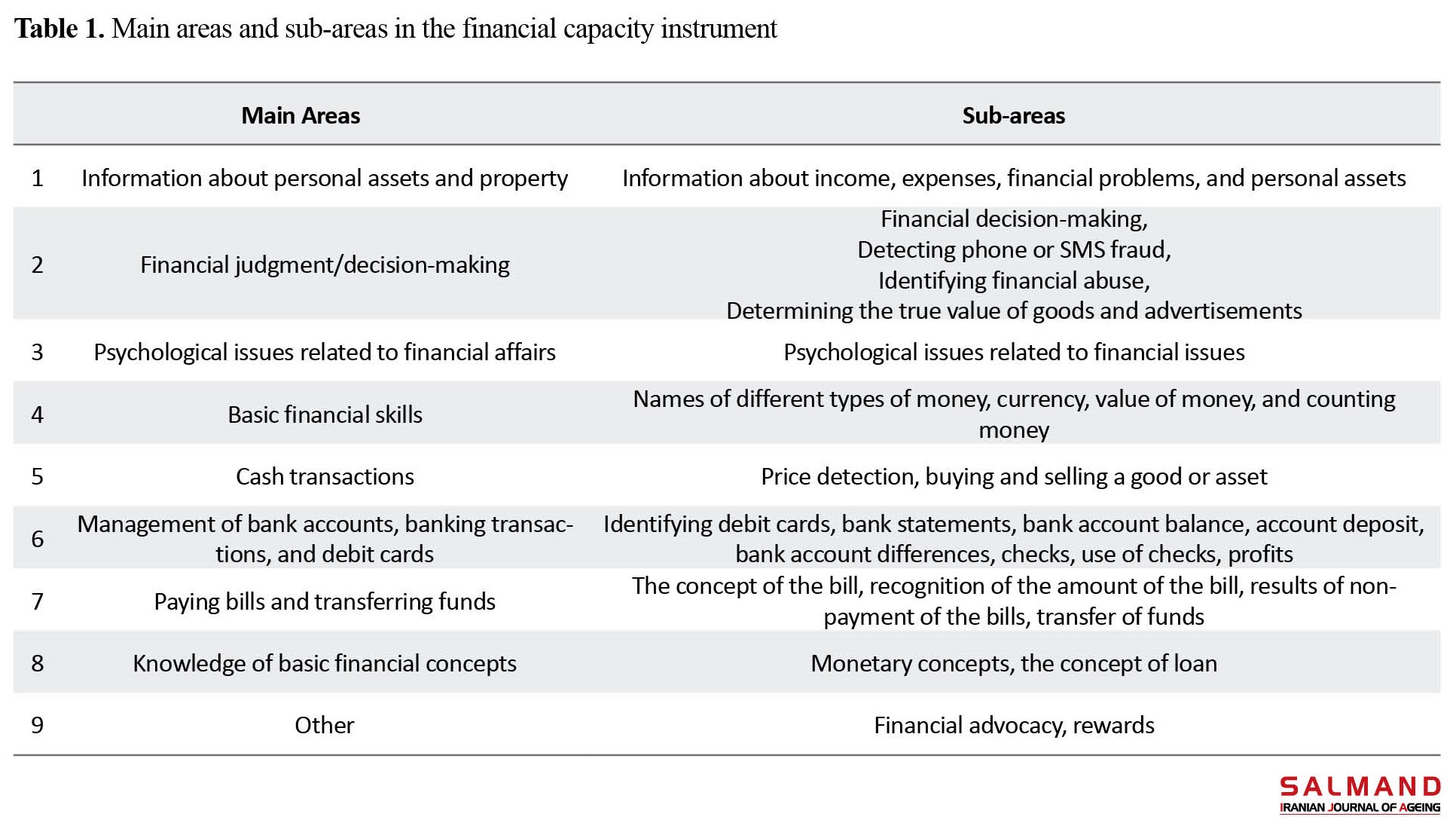

● Blueprinting: The initial draft of the tool, including main and secondary areas (Table 1), was prepared, and the relevant questions were formulated according to the opinion of experts.

● Construction: It includes the use of procedures, item sets, and scoring rules to construct the measure.

To check and determine the validity of the tool, its face validity and content validity were evaluated. A content validity ratio (CVR) with a value of 0.56 was considered as the critical point and the necessity of the item, and a CVI >0.7 was considered as a measure of the simplicity, relevance, and clarity of the items.

Results

In the first step, 15 studies were found that had used 11 tools for measuring financial capacity. Instruments had been published from 1996 to 2015. There was a web-based instrument called the financial capability scale- short form (FCI-SF) designed in 2022. All instruments covered different domains of financial capacity, except for one instrument that focused on more limited domains (psychological issues). The instruments were for different target groups, but mainly for healthy and cognitively impaired older people.

In the second step, the initial draft, including 9 main areas, 27 sub-areas, and 158 items (2-3 items in each sub-area), was prepared. The items in this questionnaire cover the following areas:

● The history of having financial responsibilities, the problems and difficulty performing financial tasks, the way of making financial decisions and judgments according to the social and cultural conditions, as well as environmental support and limitations;

● Cognitive assessment with emphasis on declarative memory and executive processes of judgment, planning, and reasoning;

● Psychological assessment to determine the effective role of psychological symptoms in managing financial affairs;

● Performance-based assessment of financial capacities;

● Assessing the vulnerability to fraud and financial abuse.

The values of CVR for 34 items were >0.56. The number of accepted items with a CVI >0.7 was 57 items. For 8 items, the CVI was <0.7. Finally, 68 items were reduced to 65 items. In addition, based on the opinions of the target group and the panel of experts during the qualitative content validity determination, the items were revised and the necessary corrections were made on them. The CVR and CVI for the overall scale were 0.57 and 0.83, respectively. By developing guidelines for each item, acceptable or unacceptable answers and scoring method were determined.

Conclusion

With a broader assessment approach and due to its semi-structured nature and accompanying instructions, the designed tool can help clinicians in Iran to more accurately find older people who are no longer able to manage their financial affairs. Also, this tool can help categorize the levels of financial capacities in an older person. This study was a pilot study, and the inter-rater reliability, test re-test reliability, and construct validity of the tool were not evaluated. In future studies, it is recommended to prepare a short version of this tool for quick and easier use in clinical practice. By determining the relationship of the score of this tool with the level of education, cognitive level, or other involved criteria, a cut-off point can be determined for this tool.

Ethical Considerations

Compliance with ethical guidelines

This study was approved by the Ethics Committee of Iran University of Medical Sciences (Code: IR.IUMS.FMD.REC.1400.172).

Funding

This article is extracted from the PhD dissertation of Razieh Bakhshande, approved by Department of Psychiatry, School of Medicine, Iran University of Medical Sciences.

Authors' contributions

Conceptualization: Behnam Shariati and Vahid Rashedi; Methodology, investigation, funding acquisition and resources: All author; Writing the original draft: Vahid Rashedi, Behnam Shariati and Razieh Bakhshandeh; Review & editing: Vahid Rashedi, Behnam Shariati and Razieh Bakhshandeh; Supervision: Behnam Shariati, Vahid Rashedi.

Conflicts of interest

The authors declared no conflict of interest.

Acknowledgements

The authors express their gratitude for the cooperation of respected experts: Kaveh Alavi, Seyed Vahid Shariat, Hamid Yousefi, Leila Sadiq Moghadam, Marjan Haghi, Mahshid Foroughan, Pooya Farrokhnejad Afshar, Majid Rahimi, Maryam Nik Solat and Seyed Mehdi Saberi" for designing and preparing the preliminary psychometrics of this tool.

The capacity to manage financial affairs is a multidimensional construct and includes a wide range of judgment, perceptual, and pragmatic activities, ranging from the most basic abilities to higher levels of abilities. With aging, some cognitive functions such as memory, attention, judgment, and managing financial affairs are affected. The decline of cognitive abilities and financial capacity in the elderly can cause problems for them, their families, and society. Due to the fact that so far, no any questionnaire in accordance with the social and cultural conditions of Iranian society has been designed to measure the financial capacity of the elderly, the present study aims to design and develop a tool for measuring the financial capacity of Iranian elderly.

Methods

This study was conducted in four steps using Waltz’s strategy:

● Defining objectives: Identifying the available tools for measuring financial capacity (by information retrieval, combining evidence, interpreting clinical research, evaluating different areas of the tool) and designing the tool through a collaborative process and consensus;

● Selecting a conceptual model: The tools for measuring the financial capacity were found based on a literature search, their contents were analyzed, and the related concepts were extracted;

● Blueprinting: The initial draft of the tool, including main and secondary areas (Table 1), was prepared, and the relevant questions were formulated according to the opinion of experts.

● Construction: It includes the use of procedures, item sets, and scoring rules to construct the measure.

To check and determine the validity of the tool, its face validity and content validity were evaluated. A content validity ratio (CVR) with a value of 0.56 was considered as the critical point and the necessity of the item, and a CVI >0.7 was considered as a measure of the simplicity, relevance, and clarity of the items.

Results

In the first step, 15 studies were found that had used 11 tools for measuring financial capacity. Instruments had been published from 1996 to 2015. There was a web-based instrument called the financial capability scale- short form (FCI-SF) designed in 2022. All instruments covered different domains of financial capacity, except for one instrument that focused on more limited domains (psychological issues). The instruments were for different target groups, but mainly for healthy and cognitively impaired older people.

In the second step, the initial draft, including 9 main areas, 27 sub-areas, and 158 items (2-3 items in each sub-area), was prepared. The items in this questionnaire cover the following areas:

● The history of having financial responsibilities, the problems and difficulty performing financial tasks, the way of making financial decisions and judgments according to the social and cultural conditions, as well as environmental support and limitations;

● Cognitive assessment with emphasis on declarative memory and executive processes of judgment, planning, and reasoning;

● Psychological assessment to determine the effective role of psychological symptoms in managing financial affairs;

● Performance-based assessment of financial capacities;

● Assessing the vulnerability to fraud and financial abuse.

The values of CVR for 34 items were >0.56. The number of accepted items with a CVI >0.7 was 57 items. For 8 items, the CVI was <0.7. Finally, 68 items were reduced to 65 items. In addition, based on the opinions of the target group and the panel of experts during the qualitative content validity determination, the items were revised and the necessary corrections were made on them. The CVR and CVI for the overall scale were 0.57 and 0.83, respectively. By developing guidelines for each item, acceptable or unacceptable answers and scoring method were determined.

Conclusion

With a broader assessment approach and due to its semi-structured nature and accompanying instructions, the designed tool can help clinicians in Iran to more accurately find older people who are no longer able to manage their financial affairs. Also, this tool can help categorize the levels of financial capacities in an older person. This study was a pilot study, and the inter-rater reliability, test re-test reliability, and construct validity of the tool were not evaluated. In future studies, it is recommended to prepare a short version of this tool for quick and easier use in clinical practice. By determining the relationship of the score of this tool with the level of education, cognitive level, or other involved criteria, a cut-off point can be determined for this tool.

Ethical Considerations

Compliance with ethical guidelines

This study was approved by the Ethics Committee of Iran University of Medical Sciences (Code: IR.IUMS.FMD.REC.1400.172).

Funding

This article is extracted from the PhD dissertation of Razieh Bakhshande, approved by Department of Psychiatry, School of Medicine, Iran University of Medical Sciences.

Authors' contributions

Conceptualization: Behnam Shariati and Vahid Rashedi; Methodology, investigation, funding acquisition and resources: All author; Writing the original draft: Vahid Rashedi, Behnam Shariati and Razieh Bakhshandeh; Review & editing: Vahid Rashedi, Behnam Shariati and Razieh Bakhshandeh; Supervision: Behnam Shariati, Vahid Rashedi.

Conflicts of interest

The authors declared no conflict of interest.

Acknowledgements

The authors express their gratitude for the cooperation of respected experts: Kaveh Alavi, Seyed Vahid Shariat, Hamid Yousefi, Leila Sadiq Moghadam, Marjan Haghi, Mahshid Foroughan, Pooya Farrokhnejad Afshar, Majid Rahimi, Maryam Nik Solat and Seyed Mehdi Saberi" for designing and preparing the preliminary psychometrics of this tool.

References

- United Nations. World population prospects 2019: Highlights. New York: United Nations; 2019. [Link]

- Statistics Center of Iran. [Results of the 2016 population and housing census (Persian)]. Tehran: Statistics Center of Iran; 2016. [Link]

- GliskyEL. Changes in cognitive function in human aging. In: Riddle DR, editor. Brain aging: Models, methods, and mechanisms. Boca Raton: CRC Press; 2007. [DOI:10.1201/9781420005523-1]

- Joghataei MT, Nejati V. [Assessment of health status of elderly people in the city of Kashan (Perian)]. Salmand Iranian Journal of Ageing. 2006; 1(1):3-10. [Link]

- Marson DC, Sawrie SM, Snyder S, McInturff B, Stalvey T, Boothe A, et al. Assessing financial capacity in patients with Alzheimer disease: A conceptual model and prototype instrument. Archives of Neurology. 2000; 57(6):877-84. [DOI:10.1001/archneur.57.6.877] [PMID]

- Marson D. Loss of financial capacity in dementia: Conceptual and empirical approaches. Aging, Neuropsychology, and Cognition. 2001; 8(3):164-81. [DOI:10.1076/anec.8.3.164.827]

- Royall DR, Palmer R, Chiodo LK, Polk MJ. Declining executive control in normal aging predicts change in functional status: The freedom house study. Journal of the American Geriatrics Society. 2004; 52(3):346-52. [DOI:10.1111/j.1532-5415.2004.52104.x] [PMID]

- Ren L, Bai L, Wu Y, Ni J, Shi M, Lu H, et al. Prevalence of and risk factors for cognitive impairment among elderly without cardio-and cerebrovascular diseases: A population-based study in rural China.” Frontiers in Aging Neuroscience. 2018; 10:62. [DOI:10.3389/fnagi.2018.00062] [PMID] [PMCID]

- Nowrangi MA, Sevinc G, Kamath V. Synthetic review of financial capacity in cognitive disorders: Foundations, interventions, and innovations.” Current Geriatrics Reports. 2019; 8(4):257-64. [DOI:10.1007/s13670-019-00304-7] [PMID] [PMCID]

- Kiani P, Mottaghi M, Ghoddoosy A. [Investigating the relationship between financial abuse and mental health among aldery population in Shahre-Kord (Persian)]. Iranian Journal of Ageing. 2019; 14(2):212-23. [Link]

- Marson D, Sabatino C. Financial capacity in an aging society.Generations. 2012; 36(2):6-11. [Link]

- Widera E, Steenpass V, Marson D, Sudore R. Finances in the older patient with cognitive impairment: He didn’t want me to take over.” JAMA. 2011; 305(7):698-706. [DOI:10.1001/jama.2011.164] [PMID] [PMCID]

- Marson D. Conceptual models and guidelines for clinical assessment of financial capacity. Archives of Clinical Neuropsychology. 2016; 31(6):541-53. [DOI:10.1093/arclin/acw052] [PMID] [PMCID]

- Giannouli V, Tsolaki M. Is negative affect associated with deficits in financial capacity in non-depressed older adults? A preliminary study. Journal of Affective Disorders Reports. 2022; 10:100391. [DOI:10.1016/j.jadr.2022.100391]

- Marroni SP, Radaelli G, Silva IG, Portuguez MW. Instruments for evaluating financial management capacity among the elderly: An integrative literature review. Revista Brasileira de Geriatria e Gerontologia. 2017; 20:582-93. [DOI:10.1590/1981-22562017020.160207]

- Edelstein B. Challenges in the assessment of decision-making capacity. Journal of Aging Studies. 2000; 14(4):423-37. [DOI:10.1016/S0890-4065(00)80006-7]

- Pinsker DM, Pachana NA, Wilson J, Tilse C, Byrne GJ. Financial capacity in older adults: A review of clinical assessment approaches and considerations. Clinical Gerontologist. 2010; 33(4):332-46. [DOI:10.1080/07317115.2010.502107]

- Kershaw MM, Webber LS. Assessment of financial competence. Psychiatry, Psychology and Law. 2008; 15(1):40-55. [DOI:10.1080/13218710701873965]

- Howell T, Gummadi S, Bui C, Santhakumar J, Knight K, Roberson ED, et al. Development and implementation of an electronic Clinical Dementia Rating and Financial Capacity Instrument‐Short Form. Alzheimer’s & Dementia: Diagnosis, Assessment & Disease Monitoring. 2022; 14(1):e12331. [DOI:10.1002/dad2.12331] [PMID] [PMCID]

- Drima EP. Routine use of financial capacity instruments for clinical decisional capacity testing: A scoping review. 2022 [Unpublished]. [DOI:10.20944/preprints202205.0413.v1]

- Cheraghi Z, Doosti-Irani A, Nedjat S, Cheraghi P, Nedjat S. Quality of life in elderly Iranian population using the QOL-brief questionnaire: A systematic review. Iranian Journal of Public Health. 2016; 45(8):978-85. [PMID]

- Alavi Z, Alipour F, Rafiey H. [Psychosocial issues of retirement in Iran: A qualitative study (Persian)]. Iranian Journal of Ageing. 2021; 15(4):396-409. [DOI:10.32598/sija.15.4.2879.1]

- Waltz CF, Strickland OL, Len Ez. Measurement in nursing and health research. New York City: Springer Publishing Company; 2010. [Link]

- Lawshe CH. A quantitative approach to content validity. Personnel Psychology. 1975; 28(4):563-75. [Link]

- Loeb PA. Independent Living Scales: Additional record forms. Psychological Corporation;1999. [Link]

- Wadley VG, Harrell LE, Marson DC.“Self‐and informant report of financial abilities in patients with Alzheimer’s disease: Reliable and valid?” Journal of the American Geriatrics Society. 2003; 51(11):1621-6. [DOI:10.1046/j.1532-5415.2003.51514.x] [PMID]

- Vieira KM, Potrich AC, Bressan AA. A proposal of a financial knowledge scale based on item response theory. Journal of Behavioral and Experimental Finance. 2020; 28:100405. [DOI:10.1016/j.jbef.2020.100405]

- Cramer K, Tuokko HA, Mateer CA, Hultsch DF.“Measuring awareness of financial skills: Reliability and validity of a new measure.” Aging & Mental Health. 2004; 8(2):161-71. [DOI:10.1080/13607860410001649581] [PMID]

- Shivapour SK, Nguyen CM, Cole CA, Denburg NL. Effects of age, sex, and neuropsychological performance on financial decision-making. Frontiers in Neuroscience. 2012; 6:82. [PMID]

- Marson DC, Martin RC, Wadley V, Griffith HR, Snyder S, Goode PS, et al. Clinical interview assessment of financial capacity in older adults with mild cognitive impairment and Alzheimer’s disease. Journal of the American Geriatrics Society. 2009; 57(5):806-14. [DOI:10.1111/j.1532-5415.2009.02202.x] [PMID] [PMCID]

- Gerstenecker A, Eakin A, Triebel K, Martin R, Swenson-Dravis D, Petersen RC, et al. Age and education corrected older adult normative data for a short form version of the Financial Capacity Instrument. Psychological Assessment. 22016; 28(6):737-49. [DOI:10.1037/pas0000159] [PMID] [PMCID]

- Lichtenberg PA, Stoltman J, Ficker LJ, Iris M, Mast B. “A person-centered approach to financial capacity assessment: Preliminary development of a new rating scale.” Clinical Gerontologist. 2015; 38(1):49-67. [DOI:10.1080/07317115.2014.970318] [PMID] [PMCID]

- Vakili MM, Hidarnia AR, Niknami SH. [Development and psychometrics of an interpersonal communication skills scale(A.S.M.A) among Zanjan health volunteers (Persian)]. Journal of Hayat. 2012; 18(1): 5-19. [Link]

- Moye J, Marson DC. Assessment of decision-making capacity in older adults: An emerging area of practice and research. The Journals of Gerontology Series B: Psychological Sciences and Social Sciences. 2007; 62(1):P3-11. [DOI:10.1093/geronb/62.1.P3] [PMID]

- Setterlund D, Tilse C, Wilson J, McCawley AL, Rosenman L. Understanding financial elder abuse in families: The potential of routine activities theory. Ageing & Society. 2007; 27(4):599-614. [DOI:10.1017/S0144686X07006009]

- Gardiner PA, Byrne GJ, Mitchell LK, Pachana NA. Financial capacity in older adults: a growing concern for clinicians. The Medical Journal of Australia. 2015; 202(2):82-5. [DOI:10.5694/mja14.00201] [PMID]

- Wood S, Bally K, Cabane C, Fassbind P, Jox RJ, Leyhe T, et al. Decision-making capacity evaluations: The role of neuropsychological assessment from a multidisciplinary perspective. BMC Geriatrics. 2020; 20(1):535. [PMID]

- Greene AJ. Elder financial abuse and electronic financial instruments: Present and future considerations for financial capacity assessments. The American Journal of Geriatric Psychiatry. 2022; 30(1):90-106. [DOI:10.1016/j.jagp.2021.02.045] [PMID]

- Palmer BW. Improving knowledge of capacity assessment. International Psychogeriatrics. 2021; 33(9):857-9. [DOI:10.1017/S1041610221000727] [PMID]

- Flint L, Sudore R, Widera E. Assessing financial capacity impairment in older adults. Generations. 2012; 36(2):59-65. [Link]

- Peisah C, Finkel S, Shulman K, Melding P, Luxenberg J, Heinik J, et al. The wills of older people: Risk factors for undue influence. International Psychogeriatrics. 2009; 21(1):7-15. [DOI:10.1017/S1041610208008120] [PMID]

- Pinsker DM, Stone V, Pachana N, Greenspan S. Social Vulnerability Scale for older adults: Validation study. Clinical Psychologist. 2006; 10(3):109-19. [DOI:10.1080/13284200600939918]

- Fong JH, Koh BS, Mitchell OS, Rohwedder S. Financial literacy and financial decision-making at older ages. Pacific-Basin Finance Journal. 2021; 65:101481. [DOI:10.1016/j.pacfin.2020.101481]

- Lusardi A, Mitchell OS, Curto V. Financial literacy and financial sophistication in the older population. Journal of Pension Economics & Finance. 2014; 13(4):347-66. [DOI:10.1017/S1474747214000031] [PMID] [PMCID]

- Gamble KJ, Boyle PA, Yu L, Bennett D. Aging and financial decision making. Management Science. 2015; 61(11):2603-10. [DOI:10.1287/mnsc.2014.2010] [PMID] [PMCID]

- van Leeuwen KM, van Loon MS, van Nes FA, Bosmans JE, de Vet HCW, Ket JCF, et al. What does quality of life mean to older adults? A thematic synthesis. PloS One. 2019; 14(3):e0213263. [DOI:10.1371/journal.pone.0213263] [PMID] [PMCID]

- Giannouli V, Tsolaki M. Self-awareness of cognitive efficiency, cognitive status, insight, and financial capacity in patients with mild AD, aMCI, and Healthy Controls: An intriguing liaison with clinical implications? Neurology International. 2022; 14(3):628-37. [DOI:10.3390/neurolint14030051] [PMID] [PMCID]

Type of Study: Applicable |

Subject:

Psychiatry

Received: 2022/12/09 | Accepted: 2023/02/19 | Published: 2023/10/01

Received: 2022/12/09 | Accepted: 2023/02/19 | Published: 2023/10/01

Send email to the article author

| Rights and permissions | |

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. |